Why Is Physical Bullion Gaining Popularity? Find Out

In recent years, more and more individuals are turning to physical bullion as a means of protecting their wealth. This shift reflects a growing sentiment that traditional financial systems may not always be reliable. What is driving this trend? Let’s explore several key factors that contribute to the increasing allure of physical bullion. The Search

In recent years, more and more individuals are turning to physical bullion as a means of protecting their wealth. This shift reflects a growing sentiment that traditional financial systems may not always be reliable.

What is driving this trend? Let’s explore several key factors that contribute to the increasing allure of physical bullion.

The Search for Tangible Assets

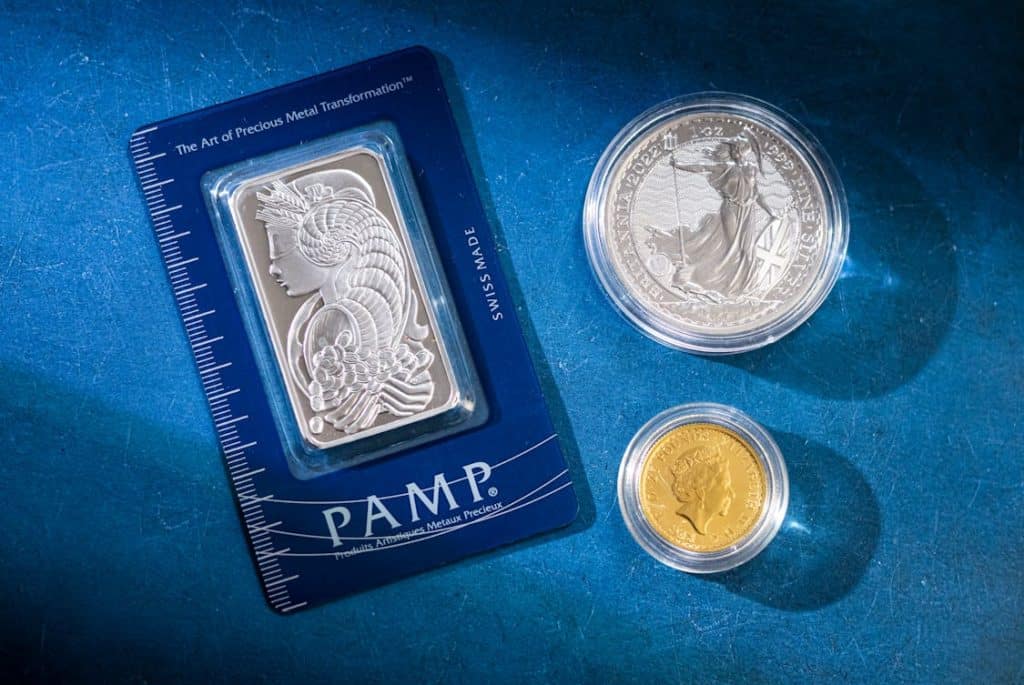

One of the primary reasons people are gravitating towards physical bullion is the desire for tangible assets. In a digital-first world, where much of our wealth exists on screens, the physicality of gold and silver offers a sense of security.

Holding something solid in your hands can feel more reassuring than a virtual account balance. The simplicity of a gold bar or silver coin is appealing in its own right.

Furthermore, tangible assets are less susceptible to technological failures or system outages. A power outage or a cybersecurity breach can leave digital currencies in limbo, but a gold coin is impervious to such issues.

Many investors find comfort in knowing their wealth is stored in a physical form that requires no intermediary.

Hedge Against Inflation

Inflation is a persistent concern for many economies, and this has fueled interest in physical bullion. When inflation rises, the purchasing power of currency declines.

In stark contrast, gold and silver tend to retain their value over time, making them attractive options for preserving wealth.

Consider this: while paper money may lose value, precious metals often appreciate or at least hold steady against inflationary pressures. Investors often flock to gold during times of economic uncertainty, viewing it as a safe haven.

This perspective has grown stronger as economic fluctuations become more common.

Global Economic Uncertainty

The world economy is subject to various shocks, be it geopolitical tensions, trade wars, or public health crises. Such uncertainties can lead people to seek out safe-haven investments.

Bullion has historically played this role, acting as a reliable store of value when times get tough.

The recent pandemic, for instance, prompted many to rethink their investment strategies.

With stock markets becoming volatile and government debts ballooning, the notion of safeguarding wealth with tangible assets becomes appealing. Gold and silver can act as an anchor in shifting financial seas, providing a stable fallback.

Diversification of Investment Portfolios

Diversification is a fundamental principle of investing, and physical bullion fits seamlessly into this strategy. By allocating a portion of their portfolios to precious metals, investors can mitigate risks associated with other asset classes like stocks or bonds.

Having a varied portfolio can help reduce overall risk, and bullion serves as a counterweight during market downturns.

When equities tumble, precious metals may hold steady or even gain value, making them an essential component for those looking to balance their investments.

The Rise of E-commerce and Accessibility

The rise of e-commerce has made purchasing physical bullion easier than ever. Online platforms allow investors to buy gold and silver from the comfort of their own homes.

For example, Money Metals offers a user-friendly experience that simplifies the process of acquiring precious metals online.

This ease of access has lowered the barrier to entry, enabling more people to invest in physical assets without needing to go through traditional channels.

Shipping options and secure storage solutions are also widely available. This convenience has transformed the landscape of bullion investment, appealing to both seasoned investors and newcomers alike.

It’s not just for the wealthy anymore; anyone can explore the world of precious metals with just a click.

Collectible Value and Aesthetics

Another factor driving interest in physical bullion is the collectible aspect. Many people are drawn to the artistry and history behind coins and bars.

The beauty of a well-crafted piece can be as enticing as its investment potential.

Collectible coins, in particular, can appreciate in value beyond their metal content due to rarity, historical significance, or demand among collectors. This dual appeal of both investment and enjoyment adds a layer of richness to bullion ownership that is hard to ignore.

Cultural and Historical Significance

Gold and silver have held cultural and historical significance for centuries. Different societies have revered these metals for their beauty and scarcity, often associating them with wealth and power.

This longstanding reverence contributes to their continued appeal in modern investment strategies.

People often feel a connection to these materials that transcends mere financial considerations. The stories and traditions tied to gold and silver can enhance their desirability, as owning physical bullion often feels like being part of an age-old tradition.

Limited Supply and Increasing Demand

The laws of supply and demand play a critical role in the value of physical bullion. As the global population grows, the demand for precious metals has surged.

However, the supply of gold and silver is finite. This imbalance can drive prices upward, making investments in bullion more attractive.

Mining costs and environmental concerns also impact supply. As accessible reserves diminish, the challenge and expense of extracting more gold and silver increase.

This reality can lead to appreciation in value over time, drawing investors who are savvy about market trends.

Educational Resources and Community Support

The rise of online educational resources has empowered investors to learn about bullion without needing to rely on third-party advisors. Blogs, webinars, and forums offer insights into market trends and investment strategies.

This democratization of knowledge has made investing in precious metals more approachable for many.

Additionally, communities surrounding precious metals investing create a supportive network. New investors can feel more confident knowing they have a group to turn to for advice and encouragement.

Changing Attitudes Toward Wealth Management

There’s been a noticeable shift in attitudes toward wealth management. The millennial generation, in particular, emphasizes alternative investments and a holistic approach to financial well-being.

Many are looking for assets that align with their values, such as sustainability and social responsibility.

Physical bullion fits into this evolving mindset. It’s seen not only as a way to grow wealth but also as a means of preserving it for future generations. The allure of leaving a legacy often resonates strongly with younger investors.

Security and Privacy Concerns

Concerns about privacy and security in the digital landscape have caused some to rethink their investment choices. With increased scrutiny on financial transactions and data breaches, possessing physical assets offers an appealing level of privacy.

When you own gold, it’s yours, and its value doesn’t depend on a digital footprint. For some, the simplicity of physical assets is a major selling point. The idea that one can hold wealth in their hands, away from prying eyes, is reassuring.

Economic Cycles and Market Volatility

Lastly, economic cycles and market volatility play significant roles in the rising popularity of physical bullion. When markets are unstable or face downturns, many investors look for safe havens. Bullion often rises in these times, further enhancing its appeal.

Investors who have weathered turbulent markets understand the value of having a reliable asset. They are often more inclined to stack physical bullion in anticipation of future fluctuations.

Such strategic planning reflects a broader understanding of economic cycles and their impact on investments.

In summary, the growing interest in physical bullion is driven by a combination of tangible security, inflation hedging, economic uncertainty, and evolving investment strategies.

As more individuals become aware of these factors, the trend toward investing in precious metals is likely to continue expanding.